The Definitive Guide for Clark Wealth Partners

Table of ContentsThe Of Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Should KnowHow Clark Wealth Partners can Save You Time, Stress, and Money.The Of Clark Wealth PartnersThe 5-Second Trick For Clark Wealth PartnersThe 15-Second Trick For Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Top Guidelines Of Clark Wealth Partners

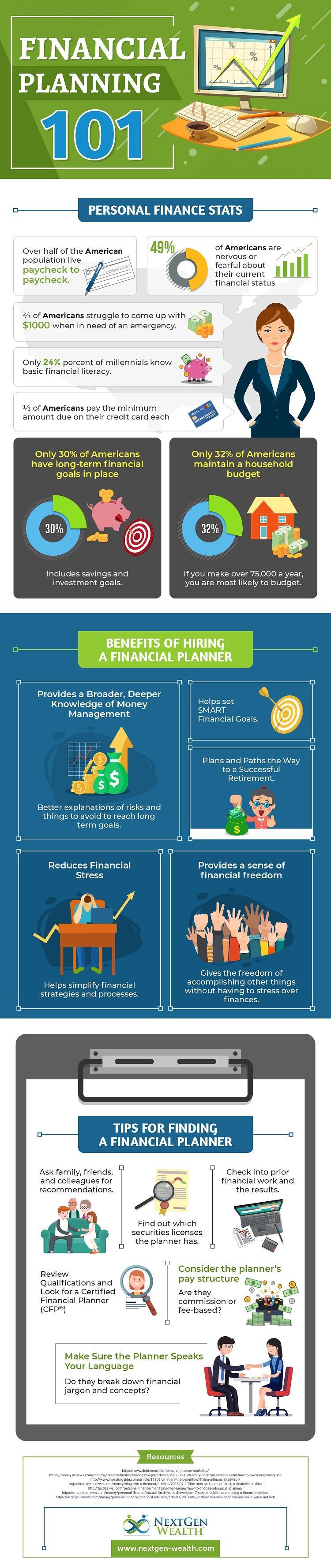

Typical reasons to think about an economic consultant are: If your economic situation has become extra intricate, or you lack confidence in your money-managing skills. Conserving or navigating major life events like marriage, separation, children, inheritance, or task modification that might considerably impact your financial scenario. Browsing the transition from saving for retirement to preserving wide range during retired life and how to produce a strong retired life income plan.New modern technology has actually caused even more extensive automated financial devices, like robo-advisors. It depends on you to check out and determine the best fit - https://clrkwlthprtnr.carrd.co/. Eventually, a great financial consultant ought to be as conscious of your investments as they are with their very own, avoiding too much charges, conserving money on tax obligations, and being as clear as possible regarding your gains and losses

What Does Clark Wealth Partners Do?

Making a commission on product suggestions doesn't always indicate your fee-based advisor functions versus your best rate of interests. But they might be a lot more inclined to recommend product or services on which they make a compensation, which might or might not remain in your finest rate of interest. A fiduciary is legitimately bound to place their client's rate of interests.

They might comply with a loosely kept an eye on "viability" requirement if they're not registered fiduciaries. This typical permits them to make recommendations for financial investments and services as long as they match their customer's objectives, risk resistance, and economic circumstance. This can convert to referrals that will certainly also make them money. On the other hand, fiduciary consultants are legitimately obligated to act in their customer's benefit as opposed to their own.

How Clark Wealth Partners can Save You Time, Stress, and Money.

ExperienceTessa reported on all points investing deep-diving into complicated monetary subjects, losing light on lesser-known financial investment avenues, and revealing ways visitors can function the system to their advantage. As a personal financing expert in her 20s, Tessa is really familiar with the effects time and unpredictability carry your investment decisions.

It was a targeted ad, and it functioned. Learn more Review less.

Some Known Incorrect Statements About Clark Wealth Partners

There's no single path to becoming one, with some individuals beginning in financial or insurance coverage, while others begin in audit. A four-year degree supplies a solid foundation for careers in financial investments, budgeting, and customer services.

Some Of Clark Wealth Partners

Usual instances include the FINRA Series 7 and Series 65 tests for protections, or a state-issued insurance coverage permit for marketing life or wellness insurance coverage. While credentials may not be legally needed for all preparing functions, companies and clients frequently view them as a criteria of professionalism. We consider optional qualifications in the next section.

The majority of economic planners have 1-3 years of experience and knowledge with economic products, compliance requirements, and direct client communication. A strong academic background is important, but experience demonstrates the capacity to use theory in real-world setups. Some programs integrate both, allowing you to complete coursework while gaining supervised hours through teaching fellowships and practicums.

A Biased View of Clark Wealth Partners

Numerous get in the area after functioning in banking, accountancy, or insurance coverage, and the change requires persistence, networking, and often advanced qualifications. Very early years can bring lengthy hours, pressure to construct a customer base, and the need to continuously show your know-how. Still, the profession supplies strong long-term possibility. Financial planners enjoy the possibility to function closely with clients, overview crucial life choices, and often accomplish flexibility in timetables or self-employment.

Wealth managers can raise their revenues through commissions, asset fees, and performance bonus offers. Monetary supervisors supervise a group of monetary planners and advisors, setting departmental approach, taking care of conformity, budgeting, and directing inner procedures. They spent much less time on the client-facing side of the market. Virtually all monetary managers hold a bachelor's degree, and numerous have an MBA or similar graduate level.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

Not known Factual Statements About Clark Wealth Partners

Optional qualifications, such as the CFP, normally call for additional coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Stats, individual financial advisors gain a typical annual yearly salary of $102,140, with top income earners gaining over $239,000.

In various other districts, there are policies that need them to satisfy particular requirements to make use of the financial expert or monetary organizer titles (financial advisor st. louis). What establishes some financial experts besides others are education and learning, training, experience and certifications. There are numerous classifications for monetary experts. For economic organizers, there are 3 usual designations: Certified, Personal and Registered Financial Coordinator.

About Clark Wealth Partners

Those on salary might have a motivation to advertise the product or services their employers offer. Where to try these out discover an economic advisor will certainly depend on the kind of suggestions you require. These establishments have team that may help you understand and get certain sorts of investments. As an example, term deposits, ensured investment certifications (GICs) and common funds.